XRP Price Prediction: Will XRP Hit $3 Amid Technical Consolidation and Bullish News?

#XRP

- Technical indicators show XRP trading below key moving averages but within Bollinger Band support ranges

- Major institutional adoption through new XRP ETFs and staking developments creating positive sentiment

- $3 price target requires breaking through multiple resistance levels but supported by strong fundamentals

XRP Price Prediction

XRP Technical Analysis

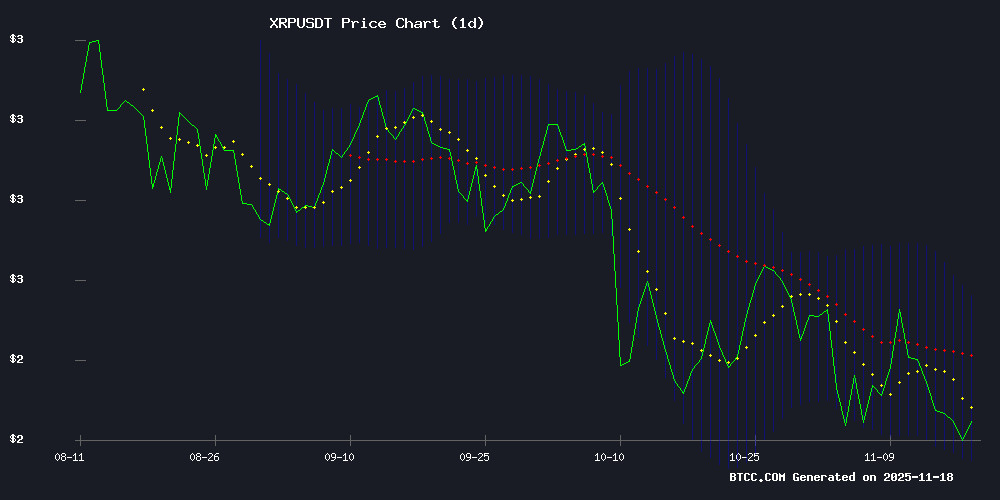

According to BTCC financial analyst James, XRP is currently trading at $2.2266, below its 20-day moving average of $2.3367, indicating potential short-term resistance. The MACD reading of -0.0088 suggests weakening momentum, though the price remains within the Bollinger Bands range of $2.1091 to $2.5644. James notes that holding above the lower band could provide support for a rebound toward the middle band.

XRP Market Sentiment Analysis

BTCC financial analyst James highlights significant positive developments for XRP, including the exploration of native staking on XRPL, the launch of Amplify's XRP-based Option Income ETF targeting 36% annual yield, and Franklin Templeton's first XRP ETF. James believes these institutional adoptions could drive substantial market Optimism and increased demand for XRP, potentially supporting higher price levels in the medium term.

Factors Influencing XRP's Price

XRPL Developers Explore Native Staking as Ecosystem Expands

David Schwartz, Ripple's CTO, has reignited discussions about potential native staking functionality on the XRP Ledger. The conversation emerges as the network sees increased activity in DeFi applications, tokenization projects, and following the launch of Canary's XRP spot ETF.

The XRP Ledger's fundamentally different architecture from proof-of-stake blockchains presents unique challenges for staking implementation. Schwartz acknowledges his evolving perspective on governance and consensus models since XRPL's 2012 launch, particularly as XRP gains utility across platforms like Flare, Axelar, and Doppler.

Market participants are watching whether XRPL's growing ecosystem demands could justify architectural changes. The network's original design prioritized speed and efficiency over programmability, but recent developments suggest shifting priorities in blockchain infrastructure.

Amplify Launches First XRP-Based Option Income ETF Targeting 36% Annual Yield

Amplify ETFs has broken new ground with the launch of the Amplify XRP 3% Monthly Premium Income ETF (XRPM), marking the first U.S.-listed exchange-traded fund to combine XRP exposure with an active options strategy. The fund aims to deliver 36% annualized income through weekly covered call writing on roughly 30-60% of its portfolio while maintaining long XRP exposure for potential price appreciation.

The YieldSmart series addition employs a bifurcated approach: systematically selling out-of-the-money calls on a portion of assets to generate premium income, while reserving the remainder for direct XRP participation. This structure attempts to balance yield generation with cryptocurrency market upside, reflecting growing institutional demand for structured crypto products.

Franklin Templeton Launches First XRP ETF, Igniting Market Optimism

Franklin Templeton, a $1.5 trillion asset management giant, has entered the XRP ETF arena with the debut of its EZRP fund on the Chicago Board Options Exchange. The launch follows Canary Capital's successful XRP ETF, which attracted $247 million in first-day inflows last week. Institutional interest is surging, with analysts revising price predictions upward as capital floods into the market.

The EZRP listing marks a watershed moment for Ripple's XRP, providing institutional investors with regulated exposure to the digital asset. Bitwise is poised to follow with its own XRP ETF on November 20, creating a domino effect of institutional adoption. Market observers note the timing aligns with renewed bullish sentiment across crypto markets.

Will XRP Price Hit 3?

According to BTCC financial analyst James, XRP reaching $3 is plausible but requires overcoming key technical hurdles and sustained positive momentum. Currently trading at $2.2266, XRP needs approximately 35% upside to reach $3. The technical setup shows resistance near the 20-day MA at $2.3367, while the Bollinger Band upper limit at $2.5644 presents another challenge. However, the recent news about XRP ETFs and native staking developments provides fundamental support that could fuel the required rally.

| Current Price | Target Price | Required Gain | Key Resistance Levels |

|---|---|---|---|

| $2.2266 | $3.00 | 34.7% | $2.3367, $2.5644 |

James suggests that if XRP can break above the Bollinger Band upper limit and maintain institutional interest from the new ETF products, the $3 target could be achievable within the next 2-3 months, provided broader market conditions remain favorable.